Moving into your first apartment is a significant milestone, signifying newfound independence and the exciting start of a new chapter. However, alongside the thrill comes the crucial responsibility of managing your finances effectively. Budgeting is paramount to ensuring a smooth transition and avoiding financial pitfalls. This comprehensive guide will equip you with the necessary knowledge and practical steps on how to budget for your first apartment, covering everything from calculating expenses to saving for a down payment and managing monthly bills. Whether you’re a recent graduate, starting a new job, or simply ready to take the leap into independent living, understanding how to create a realistic budget is the cornerstone of a successful apartment experience.

Navigating the complexities of apartment budgeting can feel overwhelming, but with careful planning and foresight, you can create a solid financial foundation. This article will break down the essential components of an apartment budget, including rent, utilities, groceries, transportation, and other essential expenses. You’ll learn how to estimate costs accurately, prioritize spending, and develop sustainable financial habits that will serve you well beyond your first apartment. By understanding and implementing the budgeting tips and strategies outlined in this guide, you can confidently embrace the excitement of your new home while maintaining financial stability and peace of mind.

Calculate Your Monthly Income

Knowing your net monthly income is the first step in budgeting for an apartment. This is the amount you actually receive after taxes and other deductions. Don’t confuse this with your gross income, which is your income before deductions.

If you have a consistent salary, calculating your net income is straightforward. Review your pay stubs to find this amount.

If your income varies, for instance, if you are a freelancer or work on commission, calculate your average net income over the past 3-6 months. This will give you a more realistic figure to work with when creating your budget.

Estimate Rent You Can Afford

Figuring out how much rent you can afford is a crucial first step in your apartment search. A common rule of thumb is the 30% rule, which suggests spending no more than 30% of your gross monthly income on rent. However, this is just a guideline.

Consider your individual financial situation. If you have significant debt or other large expenses, you may want to aim for a lower percentage. Creating a detailed budget that includes all your income and expenses can help you determine a realistic and sustainable rent amount.

Use online rent calculators or budgeting apps to assist in this process. These tools can provide a clearer picture of your affordability range and prevent you from overspending.

Include Utility and Internet Costs

Beyond rent, factor in essential utilities. These typically include electricity, gas (if applicable), and water. Contact the utility providers directly or inquire with your landlord for estimated costs. These can fluctuate seasonally.

Internet access is crucial in today’s world. Research providers and plans available in your area. Consider your usage needs when selecting a plan.

Plan for Furniture and Essentials

Furnishing your first apartment can be a significant expense. Create a detailed list of essential furniture items like a bed, sofa, and dining table. Consider multi-functional pieces to save space and money.

Beyond furniture, factor in essential household items. Think about kitchenware, bathroom essentials, and cleaning supplies. Prioritize needs over wants, and gradually acquire items as your budget allows.

Explore different avenues for acquiring furniture and essentials. Consider buying used items, checking online marketplaces, or accepting hand-me-downs from family and friends to reduce costs.

Factor in Moving Expenses

Moving into your first apartment involves more than just rent and utilities. Moving expenses often get overlooked, and they can significantly impact your budget. Consider these costs:

- Truck rental: Renting a truck or van can be a major expense, especially if you’re moving a longer distance.

- Packing supplies: Boxes, tape, bubble wrap, and other packing materials add up quickly.

- Moving help: Hiring movers, even for loading or unloading, represents a considerable cost.

- Cleaning supplies: Cleaning your old place and prepping your new apartment will require cleaning products.

- Miscellaneous: Unexpected costs may arise, such as gas for the moving truck, tolls, or last-minute storage needs.

Carefully research and compare prices for each of these expenses. Get quotes from multiple moving truck companies and look for deals on packing supplies. Factor these costs into your overall moving budget to avoid financial surprises.

Build a Security Deposit Fund

A security deposit is a lump sum of money paid upfront to your landlord. It protects them against potential damages to the property or unpaid rent. Landlords typically require one or two months’ rent as a security deposit. Start saving for this expense early in your apartment search.

Treat your security deposit fund as a high-priority savings goal. Set aside a specific amount each month to reach your target. The sooner you start, the less burdened you’ll feel.

Set Aside Emergency Savings

Moving into your first apartment comes with unexpected expenses. It’s crucial to have an emergency fund to cover these unforeseen costs. This will prevent you from falling into debt or having to rely on credit cards.

Aim to save at least three to six months’ worth of essential living expenses. This includes rent, utilities, groceries, and transportation. Having this safety net will provide financial security and peace of mind.

Start small and contribute regularly to your emergency fund. Even small amounts add up over time. Consider setting up automatic transfers to a separate savings account to make saving consistent and effortless.

Avoid Overstretching Your Budget

One of the biggest mistakes first-time renters make is overestimating how much they can afford. Set a realistic budget before you start your apartment search. Factor in not just rent, but also utilities, groceries, transportation, and other essential expenses.

The general rule of thumb is the 30% rule, meaning your rent should not exceed 30% of your gross monthly income. However, consider aiming for a lower percentage, especially when starting out, to build a safety net and avoid financial strain. Prioritize your needs over wants. A fancy apartment might be tempting, but a more affordable option will give you greater financial security.

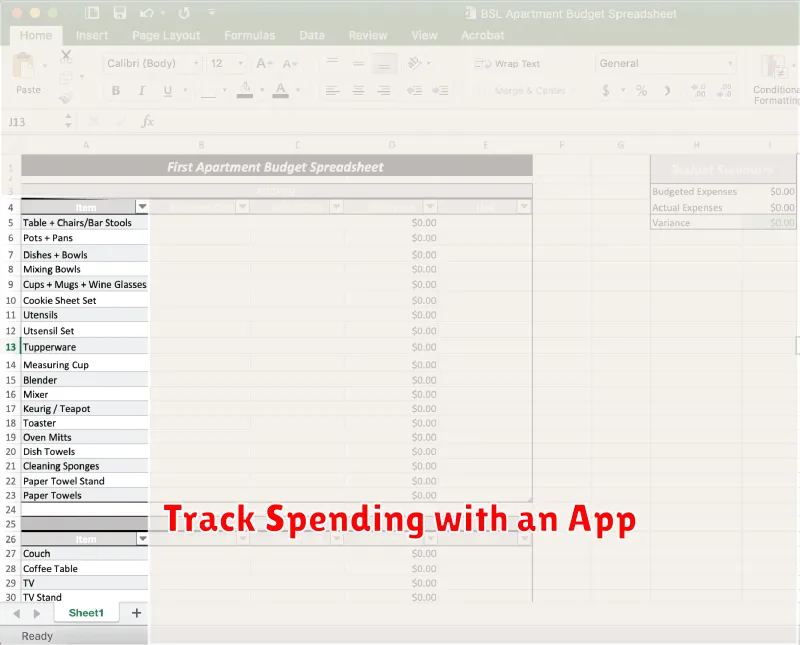

Track Spending with an App

Staying within your new apartment budget requires diligent tracking. Fortunately, many apps simplify this process. These apps can connect directly to your bank accounts and credit cards to automatically categorize your spending.

Choosing the right app is crucial. Look for features like customizable budget categories, expense reporting, and bill payment reminders. Some apps even offer personalized financial advice based on your spending habits.

By actively monitoring your expenses with an app, you can quickly identify areas where you might be overspending and adjust your habits accordingly. This real-time feedback is essential for maintaining control of your finances and staying within your budget.

Adjust and Review Regularly

Creating a budget isn’t a one-time task. It requires regular review and adjustment. Life changes, and your budget should reflect those changes.

Aim to review your budget monthly. Compare your planned expenses to your actual spending. Identify areas where you overspent or underspent.

If you consistently overspend in a particular category, consider adjusting your budget to allocate more funds to that area. Conversely, if you consistently underspend, you might reallocate those funds to other categories, such as savings or debt repayment.