Renting an apartment or house offers a sense of freedom and flexibility. However, it’s important to remember that your landlord’s insurance policy likely only covers the building itself, not your personal belongings. This is where renter’s insurance comes in. Renter’s insurance provides crucial financial protection for your possessions against unforeseen events like theft, fire, vandalism, and certain types of water damage. Understanding the benefits of renter’s insurance can provide significant peace of mind and protect you from potentially devastating financial losses.

This article delves into the intricacies of renter’s insurance, explaining the coverage it offers and why it’s a necessary investment for anyone renting a property. We’ll explore the various types of renter’s insurance policies available, the factors that influence renter’s insurance costs, and how to choose the right policy for your specific needs. By understanding the importance of renter’s insurance, you can safeguard your belongings and enjoy your rental experience with greater security.

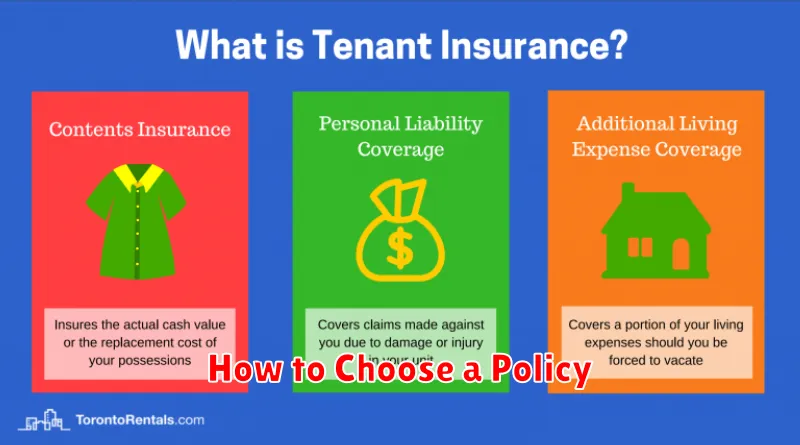

What Is Renter’s Insurance?

Renter’s insurance is a type of property insurance that provides coverage for a policyholder’s belongings and liability. It protects against losses from events like fire, theft, vandalism, and certain types of water damage. Unlike homeowner’s insurance, it does not cover the actual structure of the building, as that is the landlord’s responsibility.

A renter’s insurance policy typically covers personal possessions such as furniture, electronics, clothing, and jewelry. It can also provide liability coverage if someone is injured in your rented unit and you are found responsible. Additionally, it can cover additional living expenses if your rental becomes uninhabitable due to a covered event.

What Does It Cover?

Renter’s insurance provides crucial financial protection for your belongings and liability. It typically covers three main areas:

Personal Possessions

This covers your belongings against covered perils such as fire, theft, vandalism, and certain weather-related events. It’s important to note that not all perils are covered, so review your policy carefully. The coverage extends to your possessions even when they are outside your home, such as in your car or while traveling.

Liability Protection

If someone is injured in your rented home and you are found liable, renter’s insurance can help cover medical expenses and legal fees. This also extends to incidents that occur away from your home caused by you or a member of your household.

Additional Living Expenses

If your rented home becomes uninhabitable due to a covered peril, this coverage helps pay for temporary housing, such as a hotel, and other associated living expenses like meals. This ensures you have a place to stay while your home is being repaired or rebuilt.

How Much Does It Cost?

One of the biggest advantages of renter’s insurance is its affordability. The average cost of a policy is surprisingly low, typically ranging from $15 to $30 per month. This small expense can provide significant financial protection.

Several factors influence the premium you’ll pay. These include the amount of coverage you need, the location of your rental property, and your deductible. Higher coverage amounts and lower deductibles generally result in higher premiums. Living in areas prone to natural disasters can also increase costs.

It’s important to compare quotes from different insurance providers to find the best value for your specific needs. Don’t hesitate to ask about discounts, as many companies offer savings for things like bundling policies or having safety features in your rental unit.

Is It Required by Landlords?

While renter’s insurance is not legally mandated everywhere, more and more landlords are requiring it as part of the lease agreement. This protects their property from potential damages caused by tenants. It’s becoming increasingly common in many urban areas and for properties managed by larger management companies.

Even if your landlord doesn’t explicitly require it, obtaining renter’s insurance is a wise decision. The relatively small cost provides significant financial protection for your belongings and liability coverage in case of accidents.

How to Choose a Policy

Choosing the right renter’s insurance policy requires careful consideration of your individual needs. Coverage amounts are crucial. Evaluate your belongings and select coverage that adequately reflects their replacement value. Deductibles impact your out-of-pocket expenses in the event of a claim. A higher deductible lowers premiums, but increases your immediate costs after a covered incident.

Consider additional policy options like identity theft protection or flood insurance, depending on your circumstances and location. Comparing quotes from different insurers is essential to finding the best balance of coverage and affordability.

Understanding Liability Protection

Liability protection is a crucial component of renter’s insurance. It safeguards you financially if someone gets injured on your rented property or if you accidentally damage someone else’s property. Imagine a guest tripping on a rug in your apartment. Liability coverage could help cover their medical expenses and protect you from potential lawsuits.

This coverage extends beyond your rented unit. For instance, if you accidentally damage a neighbor’s property, your liability protection could help cover the repair costs. It provides a financial safety net, protecting your assets and future earnings.

What’s Not Covered?

While renter’s insurance offers valuable protection, it’s crucial to understand its limitations. Certain events and possessions are typically excluded from standard policies. Being aware of these exclusions can help you avoid surprises and explore additional coverage options if needed.

Common exclusions include damage caused by floods, earthquakes, and other natural disasters. High-value items like jewelry, fine art, or collectibles might have limited coverage under a standard policy and often require separate riders for adequate protection. Additionally, damage or loss due to intentional acts by the renter is generally not covered.

Filing a Claim

While we hope you never need to file a claim, understanding the process is crucial. If a covered event occurs, such as a theft or fire, contact your insurance company as soon as possible. Timely reporting is essential.

You will need to provide details about the incident and any supporting documentation, such as photos or police reports. Your insurer will assign a claims adjuster who will investigate the situation and assess the damages. They will then determine the amount you are eligible to receive based on your policy coverage.

Keep meticulous records of all communication, including claim numbers, dates, and names of individuals you speak with. This documentation can be invaluable during the claim process.

Compare Plans and Providers

Once you understand the importance of renter’s insurance, the next step is comparing plans and providers. Don’t just opt for the cheapest option. Evaluate what each plan covers and ensure it aligns with your needs.

Consider these factors when comparing:

- Coverage amounts for personal property, liability, and additional living expenses.

- Deductible options and their impact on premiums.

- Policy exclusions—what the policy doesn’t cover.

- Customer service reviews and ratings of the insurance provider.

- Available discounts, such as bundling with auto insurance.

Use online comparison tools and get quotes from multiple providers to find the best fit for your budget and coverage requirements.

Peace of Mind for Renters

Renter’s insurance offers invaluable peace of mind. Imagine a burst pipe flooding your apartment, damaging your belongings. Without insurance, you’d bear the full cost of replacement. Renter’s insurance covers your personal property against perils like fire, theft, and vandalism, providing financial protection in unexpected events.

It also offers liability protection. If a guest is injured in your apartment, renter’s insurance can help cover their medical expenses and protect you from potential lawsuits. Furthermore, if your apartment becomes uninhabitable due to a covered event, your policy can cover temporary living expenses, such as hotel bills and meals.