The age-old question of renting versus buying a home is a complex one, filled with financial considerations and lifestyle choices. Making the right decision requires careful evaluation of your current circumstances and future goals. This article explores the benefits of renting vs. buying a home, providing valuable insights to help you determine which option best aligns with your individual needs. Whether you’re a first-time home seeker, considering a change in your living situation, or simply curious about the advantages of each option, understanding the key benefits of renting and the benefits of buying is crucial.

Weighing the pros and cons of renting vs. buying a home can be a daunting task. From the financial benefits of renting, such as lower upfront costs and predictable monthly expenses, to the financial benefits of buying, like building equity and potential tax deductions, each option presents unique advantages. This comprehensive guide will delve into the multifaceted aspects of both renting and buying, offering clarity on the benefits of renting a home versus the benefits of owning a home. By exploring these key differences, you can empower yourself to make an informed decision about which housing path best suits your financial situation and personal objectives.

Lower Upfront Costs

One of the most significant advantages of renting is the lower upfront cost. When you buy a home, you’re faced with a substantial down payment, which can be a significant financial hurdle. This can range from 5% to 20% of the home’s purchase price. In addition to the down payment, closing costs, which include appraisal fees, loan origination fees, and title insurance, can add thousands more to your initial expenses. Renting, on the other hand, typically requires a security deposit and the first month’s rent.

This difference in upfront costs makes renting a more accessible option, especially for those who are just starting out or who prefer not to tie up a large amount of capital in a down payment. This allows for greater financial flexibility and the opportunity to invest funds elsewhere.

No Property Tax Responsibilities

One of the significant advantages of renting is the freedom from property tax responsibilities. As a renter, you are not directly responsible for paying property taxes. This financial burden falls on the landlord. This can represent a substantial cost saving, especially in areas with high property tax rates.

This removes the complexity of understanding and managing property tax assessments, appeals, and payments. It also provides a more predictable monthly expense, as rent typically remains consistent, whereas property taxes can fluctuate.

Maintenance Covered by Landlord

A significant advantage of renting is the reduced responsibility for maintenance. Landlords typically cover the costs and coordination of major repairs and upkeep.

This can include tasks such as plumbing issues, HVAC system repairs, roofing maintenance, and appliance replacements. The specific coverage will vary depending on the lease agreement, so it is crucial to review it carefully.

This freedom from maintenance responsibilities allows renters to save time and money, avoiding unexpected expenses and the hassle of finding reliable contractors.

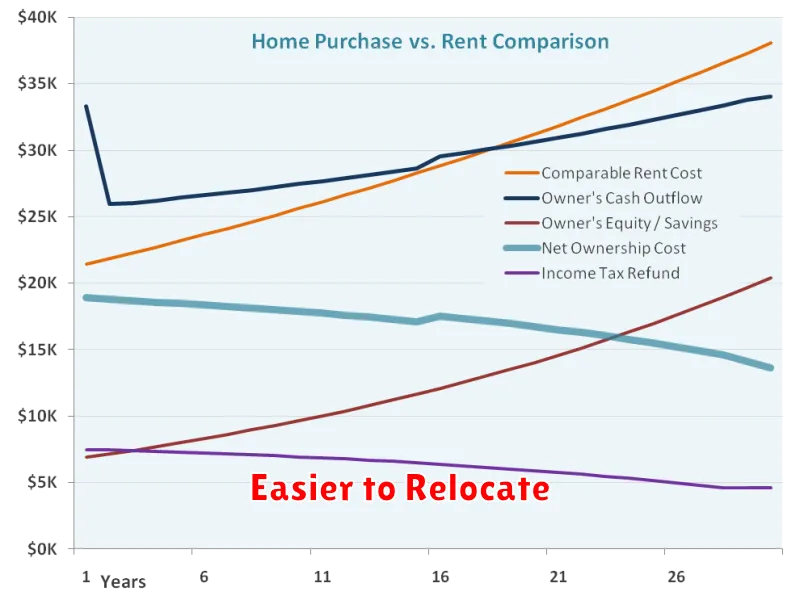

Easier to Relocate

Renting offers significantly greater flexibility when it comes to relocating. Lease terms are typically shorter than mortgage commitments, allowing renters to move with relative ease. Breaking a lease may involve some financial penalties, but these are generally less substantial than the costs associated with selling a home.

Renters are not burdened with the complexities of the real estate market. They don’t need to worry about finding a buyer, staging their property, or negotiating closing costs. This simplicity makes relocation a much less stressful process for renters.

Fewer Long-Term Commitments

Renting offers significantly greater flexibility than homeownership. Lease agreements typically span one year, allowing for relatively easy relocation compared to the long-term commitment of a mortgage, which can last for decades. This is particularly advantageous for individuals or families anticipating career changes, relocations, or lifestyle adjustments.

Renters are not burdened with the long-term financial obligations associated with property ownership, such as extensive repairs, property taxes, and homeowner’s insurance. This reduced financial responsibility allows for greater freedom and adaptability to changing circumstances. Renters can more easily adjust their housing costs to align with their evolving needs and financial situations.

No Market Risk Exposure

One of the most significant advantages of renting is the avoidance of market risk. Renters are not exposed to the fluctuations of the housing market. When home values decline, homeowners experience a loss of equity, while renters are unaffected.

Renters don’t carry the burden of worrying about decreasing property values or the potential for negative equity. They are not financially responsible for property taxes or homeowner’s insurance, further insulating them from market volatility.

Ideal for Short-Term Living

Renting offers unparalleled flexibility for individuals with short-term housing needs. If you anticipate relocating within a few years, renting eliminates the complexities and costs associated with selling a home. This is particularly advantageous for those in temporary job assignments, pursuing further education, or exploring different cities before making a long-term commitment.

Lower upfront costs are another significant advantage. Renters typically only need a security deposit and first month’s rent, a considerably smaller sum compared to the down payment, closing costs, and moving expenses associated with buying.

Furthermore, renting offers a predictable monthly expense. While rent may increase periodically, it remains a consistent outlay, unlike homeownership where property taxes, insurance, and maintenance costs can fluctuate significantly.

Good Option for Uncertain Incomes

Renting offers significant advantages for individuals with variable or unpredictable income streams. A fixed monthly rent provides budgetary stability, unlike homeownership where costs can fluctuate due to property taxes, maintenance, and repairs. If income decreases unexpectedly, renters have the flexibility to downsize to a less expensive unit or relocate to a more affordable area. This option provides a crucial safety net, mitigating the risk of financial strain associated with unexpected expenses.

The upfront costs associated with renting are substantially lower than buying. Security deposits and first month’s rent are generally less burdensome than a down payment, closing costs, and moving expenses associated with purchasing a home. This makes renting a more accessible and practical choice for those with limited savings or fluctuating income.

Freedom from Homeownership Stress

Renting offers a significant advantage over homeownership: freedom from the stresses associated with property maintenance and upkeep. As a renter, you’re not responsible for costly repairs, unexpected appliance replacements, or seasonal maintenance tasks like landscaping and snow removal. This translates to less financial burden and more free time.

Unforeseen expenses, a common source of stress for homeowners, are largely mitigated when renting. A leaky roof, a broken furnace, or a malfunctioning appliance becomes the landlord’s responsibility, not yours. This predictability in housing costs allows for better budgeting and financial planning, contributing to peace of mind.

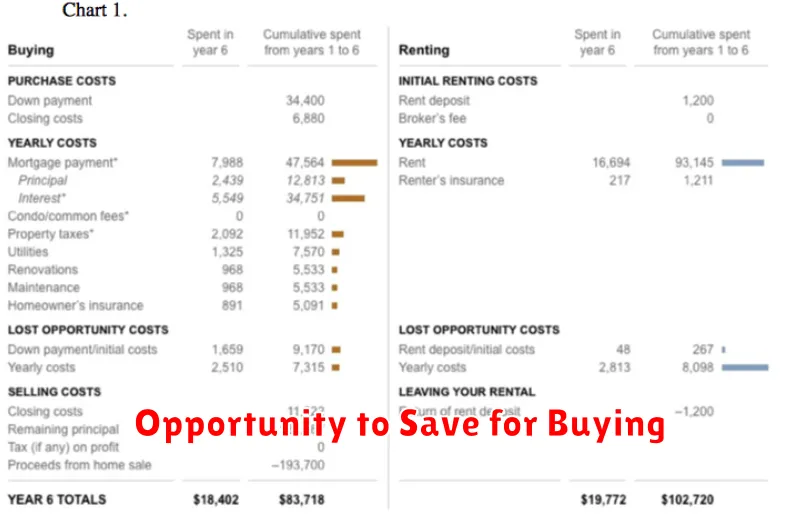

Opportunity to Save for Buying

Renting can present a valuable opportunity to save for a future home purchase. Lower monthly housing costs compared to owning, especially in certain markets, can free up funds for a down payment. Renters are typically not responsible for property taxes, homeowner’s insurance, or major maintenance expenses, which can represent significant savings.

This period of renting allows potential buyers to strategically build their financial foundation. They can focus on reducing debt, improving credit scores, and accumulating the necessary funds for a down payment and closing costs. This can place them in a stronger position when they are ready to enter the real estate market as buyers.