Applying for a rental property can be a competitive process. A well-prepared rental application can significantly improve your chances of securing the property you desire. Understanding what to include in a rental application is crucial for presenting yourself as a responsible and desirable tenant. This article will guide you through the essential components of a comprehensive rental application, increasing your likelihood of success. Learn how to effectively showcase your qualifications, financial stability, and rental history to impress potential landlords and stand out from other applicants. From credit reports and income verification to references and pet information, we will cover all the key elements to include to make your application shine.

Navigating the rental market requires preparation and understanding of the application process. This guide will provide a detailed breakdown of what landlords typically look for in a rental application. By understanding these expectations, you can proactively gather the necessary documentation and present yourself in the best possible light. We will delve into the specifics of each component, explaining why they are important and how to present them effectively. Prepare to gain a competitive edge in your rental search by mastering the art of the rental application.

Personal Identification

This section requires providing verifiable information about yourself. This allows the landlord to confirm your identity and perform necessary background and credit checks. Be prepared to provide full legal name, current address, and contact information (phone number and email address).

You may also be asked for previous addresses covering a specific period, usually the past few years. This information aids in verifying your rental history. Additionally, landlords might require a form of government-issued identification, such as a driver’s license or passport, for further verification purposes.

Proof of Income and Employment

Providing proof of income and employment is crucial for a rental application. Landlords need to verify your ability to pay rent consistently. Pay stubs are the most common form of proof, ideally showing income for the last two to three months.

If you’re self-employed, recent tax returns and bank statements can demonstrate your income stream. A letter from your employer on company letterhead confirming your employment and salary is also a valuable addition, especially if your pay stubs don’t clearly outline your annual salary. An offer letter can also serve as proof of upcoming income for a new job.

Credit History

A strong credit history is a crucial component of a successful rental application. Landlords use your credit report to assess your financial responsibility and determine the likelihood of you paying rent on time.

Your credit report typically includes details about your payment history, outstanding debts, and credit utilization. A good credit score suggests responsible financial behavior, increasing your chances of application approval. Conversely, a poor credit score can signal a higher risk to landlords.

Be prepared for a potential credit check as part of the application process. Some landlords may require your written authorization to access your credit information.

Rental History and References

Providing a comprehensive rental history is crucial for a successful application. Include contact information for previous landlords, including their names, phone numbers, and email addresses. The timeframe you should cover depends on your rental history, but aim for at least the past two years.

Landlords use this information to verify your payment history, adherence to lease terms, and overall tenancy. Be prepared to explain any gaps in your rental history. Accurate and complete information demonstrates responsibility and increases your chances of application approval.

Personal references can also strengthen your application. These references should be able to speak to your character and reliability. Provide their contact information and briefly explain your relationship with them.

Background Check Authorization

A crucial part of the rental application process involves authorizing a background check. This allows the landlord to verify information you’ve provided and assess your suitability as a tenant.

By signing the background check authorization, you grant the landlord permission to access your credit history, criminal records, and possibly eviction history. This information helps them make informed decisions about tenant selection.

Be prepared to provide necessary information such as your full name, date of birth, and social security number for the background check. Understand that a background check is a standard procedure for most rentals and is essential for both the landlord’s and tenants’ security.

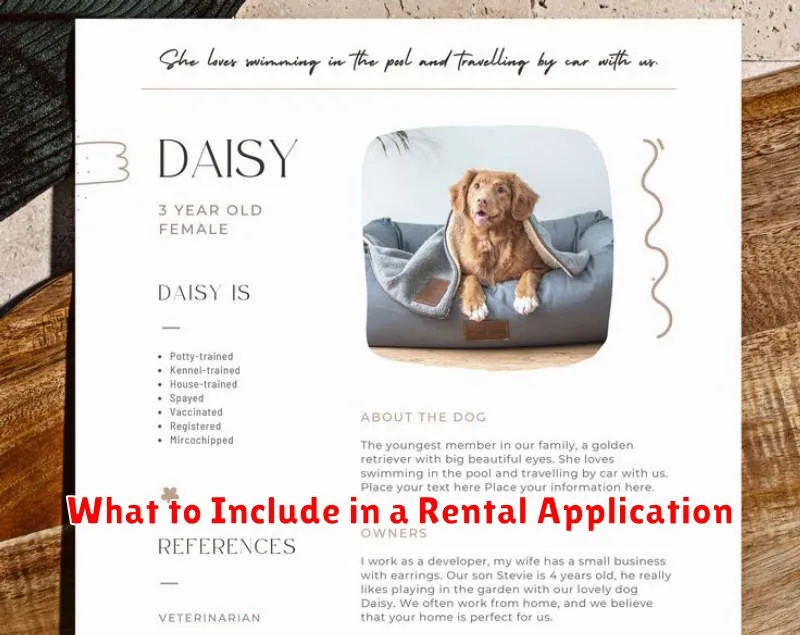

Pet Information if Applicable

This section is necessary if you have pets and intend to bring them to the rental property. Landlords often have specific pet policies, so providing accurate information is crucial.

Typically, you’ll need to disclose the type of pet, the breed, the pet’s age, and any relevant veterinary records. Some applications may request vaccination history or a pet resume to showcase your pet’s training and behavior.

Be prepared to provide the name and contact information of your veterinarian. Some landlords may also require a pet interview or a pet deposit/fee.

Emergency Contact Details

Providing emergency contact information is a crucial part of a rental application. This allows the landlord to contact someone in case of an emergency, such as an accident or if you are unreachable.

Typically, you should provide at least one emergency contact. Include their full name, relationship to you, and phone number. Ensure the contact person is aware that you are listing them and that they are comfortable fulfilling this role. Some applications may also request an address for the emergency contact.

Co-Signer Details (if needed)

A co-signer may be required if your financial history doesn’t meet the landlord’s criteria. This section requests information about the individual guaranteeing your lease. A co-signer assumes full responsibility for the lease if you fail to meet your obligations.

Typically, required co-signer information mirrors that of the primary applicant. This includes their full legal name, current address, contact information, employment details, and proof of income. The landlord will likely conduct a credit check and background check on the co-signer as well.

Cover Letter or Personal Statement

A cover letter or personal statement provides an opportunity to introduce yourself to the landlord and highlight key aspects of your application. While not always required, a well-written letter can make your application stand out.

Briefly introduce yourself and explain your current situation. State why you are looking for a new place and why you are interested in this particular property. Mention your desired move-in date.

Highlight your strengths as a tenant, such as a stable income, good rental history, and responsible personal habits. Briefly address any potential concerns in your application, like a short credit history or a pet, in a positive and proactive manner.

Be Honest and Accurate

Accuracy and honesty are crucial when completing a rental application. Providing false information can lead to immediate rejection or even future eviction. Landlords carefully review applications and often verify the information provided.

Double-check all details, including employment history, income, and previous addresses. Ensure your contact information is current so the landlord can easily reach you. Any discrepancies or inconsistencies can raise red flags and jeopardize your chances of securing the rental.